Back in December of 2008, I wrote a post explaining why you should never live on cash. The post was met with a lot of comments saying I’m wrong and credit cards are bad because they are too easy to abuse. I say you’re just not a financially responsible person if you live on cash.

Paying With Cash Cost You Money

Whenever possible, I will charge everything I buy on a credit card. The main reason for this is because it makes me money. If you’re the kind of person who never runs a credit card balance and always pay off the full amount owed every month, then you should never use cash to buy anything. Instead, use a rewards credit card that will pay you to use it. My TD Visa offers cash back on anything I charge. However, there are reward cards that offer travel points, discount on cars, gifts, etc.

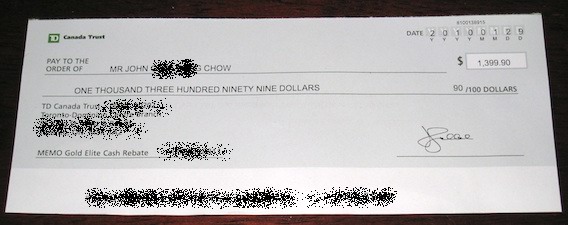

You’re going to buy that grocery anyway. Instead of paying cash at the Whole Foods and just getting the grocery, put it on your reward credit card and get some cash back or earn some points towards a nice vacation. Over the course of a year, the reward can add up to a substantial amount. This is the check TD Visa recently dropped off.

The amount represents my “cash dividend†for 2009. My visa card gives me 1% cash back on anything I charge to it. Those who are good at math will be able to work out that in order to receive a $1,399.90 dividend, I would need to charge $139,990 to my Visa card in 2009. That brings up the question, what the hell did I buy?

What I charged to my Visa isn’t the point. The point is, had I paid for those purchases in cash, I wouldn’t have received the Visa dividend. While 1% doesn’t sound like much, over the course of a year, it can add up to a nice night out on the town. Now some people living on cash may say that if I flash cash, I could get a discount bigger than 1%. In cases where a merchant offers a cash discount, I take it and don’t use the Visa. For most merchants however, flashing cash won’t give you any more discount than flashing a Visa.

Cash Is Bad, Credit Is Good

It’s amazing the number of people I’ve met who tell me to live on cash because credit is bad. The only thing I have to say to them is they don’t know how to manage their money. If you’re the type of person who shops impulsively and doesn’t keep track of your spending, then a credit card is probably not for you. However, if you always live within your means and always pay off your credit balance in full every month, then a credit card is a great financial tool and one that will make you money.

A cash back or reward credit card doesn’t work if you don’t pay it off every month. The interest on the charges will more than kill off any rewards you can ever get. I’m happy to report that even though I’ve charged $140K last year to my Visa, I was able to pay the balance off every month and incurred zero interest charges.

Now I just have to figure out what I’m going to do with this dividend check. 😀