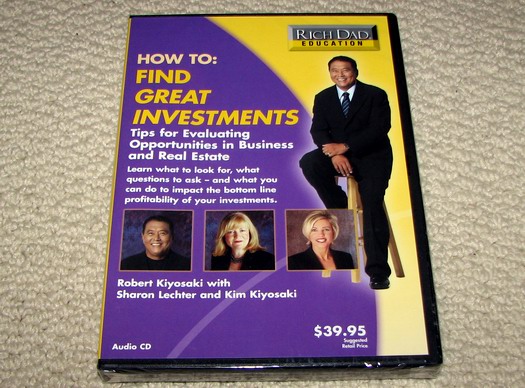

This post was written by Alan LeStourgeon from Affiliate Confession, the winner of the Rich Dad CD contest.

I was fortunate enough to win a Rich Dad CD from John a few weeks ago and after listening to it, I think there are some valuable lessons for Internet marketers. Granted, Rich Dad is into investing and real estate, a much different niche than blogging and affiliate marketing, but the goal for any entrepreneur is to work towards financial freedom so it is worthwhile to listen to someone who has attained that.

The Rich Dad CD was 45 minutes long and even though much of it was a rehash of previous lessons learned about finances and real estate from reading Kiyosaki’s books, there were 4 points I think can relate to Dot Com Moguls.

Don’t Own or Invest In What You Don’t Control

This is why many affiliate managers get into affiliate marketing. They see how much people are making with some of the programs they manage, they think about their salaries and then decide to put their hat in the affiliate ring. They finally get the picture just like so many that want to work for themselves. If you are putting in time at a job to build someone else’s business, you are investing in what you don’t control. Your blog or your business can build your brand and give you more control over your financial destiny.

It is also important to eventually create products of your own such as John has done with TTZ Media, we’ve done with our Mostly Raw Vegan Meal Planner and others have done with ebooks, software, plugins and a whole host of other things. When you are marketing your own product, every time a customer looks at or uses it, you have the potential to brand yourself again and again.

Look For Trends

What this means for the affiliate marketer is to be aware of buying seasons, new products, industry news and the general happenings in the niches you’ve chosen to operate in. If you are aware of new products and buying trends, you can adjust your affiliate offers to meet the demands of an ever changing marketplace and earn substantial profits. An added benefit is that your customers will recognize you as an industry leader and continue to return to your site or blog so they can be informed on the latest happenings and products as well.

Know The Industry You Invest In

Do you read blogs, news and keep up with what is happening with affiliate marketing? Have you made it a point to read industry magazines related to the products you market. If you educate yourself on the merchandise you offer up to your visitors, you will be much more likely to be in tune with buyers of those products. Have you ever been to a web site where it’s obvious from the descriptions that the writer has never used the product? Does it make you feel like buying from them even if it’s a product you desperately want or need?

Do you have affiliate offers that are related to your hobbies, interests and passions? Why reinvent the wheel here? If you are into a hobby that’s hugely popular, take advantage of the knowledge you have already attained. You may not feel like an expert, but you can position yourself as one fairly easily from the knowledge you have in your brain right now.

Cash Flow Instead Of Capital Gains

A perfect example of this was reported by John Cow just a few days ago when he reported he had turned down an offer of $30,000 for his blog. That’s a lot of money for a 6 month old blog, but there’s a lot more potential in having the $3,500 per month reportedly coming in than a big wad of cash. First, you are likely to spend a large windfall such as this much quicker than if you earn it month by month and second, the Cow’s blog may be earning as much per month as the initial offer if he waits another year. Look what happened to this blog after only 1 year, what if Chow had sold out 6 months ago for $30K? If he had, I wouldn’t have won the Rich Dad CD and learned these lessons and you wouldn’t be reading this post.