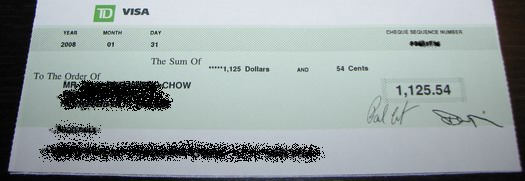

TD Visa sent me a nice fat check for $1,125.54 today for using their credit card. I have a TD Gold Elite Visa that gives me 1% cash back on anything I buy with the card. And unlike some other cash back cards, the TD Visa has no rebate limits.

The check above represents my “dividend” for 2007. Those who are good at math will be able to figure out that in order to receive $1,125.54 cash back, I needed to charge $112,554.00 to the Visa last year. This begs the question, what the hell did I buy?

Only The Financial Illiterates Pay By Cash

Whenever possible, I always charge my purchases to a credit card. People who say you should only pay with cash so you can stay out of debt are financial illiterates who can’t handle their money. If that is you, then yes, you should only pay with cash and cut up the charge cards.

If you are responsible with your money, then a credit card is a great thing because you can make money from it. There are tons of reward cards that you can apply for that will give you money back on purchase, points, air miles or other rewards. If I were to pay my last year’s Visa purchases with cash, I would not be getting this thousand dollar check. Best of all, the money is tax free because it’s not income. It’s a rebate of my purchases.

Not for The Financial Illiterates

You have to be very careful with reward credit cards. They can twist your thinking inside out. Instead of thinking how much something cost, you start thinking how much cash back you’ll be getting and forget that you have to pay the bill when it shows up. Do too much of that and you’ll soon find yourself running a balance and incurring interest charges, which will not be offset by any rewards you will get. This is how financially illiterate people fall into the credit card trap. Although I charged over $100,000 to my Visa last year, I am happy to report I paid off the full balance every month and incurred zero interest charges.

What Kind of Credit Card is Right for You?

Wondering what kind of credit card you should apply for? Then check out this credit card site. It takes your information and then finds a card that will match your needs. When used properly, credit cards are a great financial tool that will make you money.

Now I just have to decide what I’m going to do with this dividend check. Valentine’s Day is just around the corner so I may blow it all on a huge night on the town with Sarah. I will charge the night out on the Visa of course. 😈