I doubt my property flip will make for good TV but I figure I’ll tell you anyway. First of all, the flip is not finished since I haven’t sold it yet. Second of all, there is no renovation involved since the place is brand new. As a matter of fact, it’s so new it hasn’t even been built yet. You see, what I’m flipping (assuming I do end up flipping it) is not a house at all. It’s a pre-sell.

One of the ways real estate developers raise money to build projects is by pre-selling it. The buyer puts some money down (5% to 25%) to secure their units and the developers will get needed fund to start building. Having a pre-sold project makes it easier for the developer to get financing from the banks. When the development is done, the buyers have to pay the remaining balance. Some project can take years to complete. During this time, the buyer is holding what is known as an assignment. This assignment can be sold should the buyer not wish to take delivery of the completed project.

Eight months ago I purchased a 2 bedroom condo pre-sale at the Versanti, a high rise development scheduled for completion by December 2007. The unit cost me $300,000. Terms were 5% down at signing, 10% within 60 days of signing and balance on delivery. So it cost me $45,000 to secure the assignment. Right now I can sell the assignment for $350,000. That’s over 100% return on my money in just 8 months.

The beauty of holding pre-sales is once you put your money down; you don’t have to do anything until the unit is ready to be moved into. No need to make mortgage payments, no need to do any renovations, no need to pay property taxes or any other housing costs. If I really wanted to increase my rate of return, I can use my line of credit to buy it. Then the return would be infinite because I put in zero dollars of my own money. I would have to pay the interest on the credit line (at prime) but that will be tax deductible because it’s for investment purposes.

The downside with this investment is the same as a normal house flip. This only works in a rising market. If housing prices goes down, I will be losing money. However, the real estate market in Vancouver is so hot I don’t foresee it going down anytime soon.

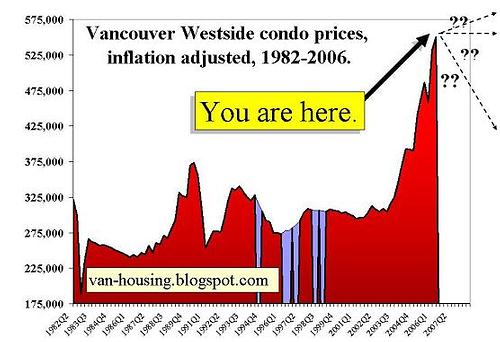

I posted the above chart in a blog entry back in Mar of 2006. Back then the chart went to 2005 and showed the average Westside condo at $475,000. The chart now includes Q2 2006 numbers and as you can see, the price is still going up. And I see it continuing to go up at least until the 2010 Olympic games gets here.

I am looking for more pre-sales to buy but haven’t been having much luck because developments get sold out so fast. If you’re not there on the first hour, chances are you won’t be getting a unit. I tried to pick up a 1 bedroom condo at Mandalay Richmond but by the time I got there (1 hour after opening) all the 1 bedrooms were sold! I am now waiting for them to start selling Phase 2. To get maximum money, developers sell their pre-sales in phases even if they can sell out everything with one sale. The reason they do this is to take advantage of the rising prices. When Phase 2 goes on sale, it will cost $10,000 or more per unit than Phase 1. Phase 2 units are the same as Phase 1.

I have found a way to get around the line ups at new pre-sales. My realtor has offer to line up for me. So when Phase 2 of Mandalay goes on sales, she will be there lining up 2 hours before the doors open. Then I just show up at opening time and sign the papers. I get the unit and she’ll make $6,000 in buyer’s commission. Not bad for lining up for 2 hours.