If I were to ask you which investment is more risky; real estate or stock market, which would you say? The majority of people I have spoken to over the years say the stock market is more risky. No doubt this is due to a general lack of experience or knowledge of the stock market, while nearly everyone has experience with real estate (either by owning or renting). The truth of the matter is, from an investment stand point, real estate is a much more risky investment than the stock market.

One of the biggest measures of risk is liquidity – how fast can you turn the investment into cash. If you need cash now, can you dump that house overnight? Chances are the answer is no (not without a big discount anyway). On the other hand, I can log on to my TD Waterhouse account, and with a click of the mouse, issue a market sell order on my stocks and those stocks will be gone in less than 30 seconds. The lack of liquidity is the main reason real estate is a higher risk investment. The other one is performance.

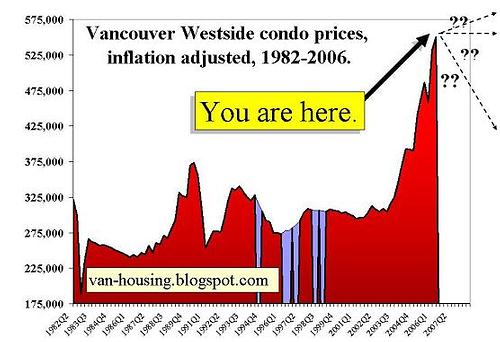

Historically, real estate returns are not as high as the stock market. Sure there are times when things go crazy, like right now, but on average real estate goes up at the rate of inflation. Also, when there’s a real estate crash, it can last a long time.

If you brought a condo in 1990, you didn’t recover your investment until 2004. That’s 14 years! By comparison if you take any five year points on the S&P 500 index, you’ll see that the end point is always higher than the start point. This is why you always hear financial planners say you should invest for at least 5 years. However, this 5 year strategy doesn’t apply to real estate.

Real estate’s main advantage over the stock market is leverage. And we all know that leverage is the key to building wealth. While you can set up a margin account to buy stocks with borrowed money, the most a broker will lend on such an account would be 50%. By comparison, banks will lend up to 95% on a house. That means you don’t need the investment to do well to get a great return. If you borrow $95,000 to buy a $100,000 house, the house only needs to go up by 5% for you to double your double your money. However, the tremendous leverage available also makes real estate riskier. Should the price of the house drop 5%, you just lost all your money.

There are ways to take advantage of the leveragability of real estate with the lower risk of the stock market. The best is the home equity line of credit and systematic withdrawal plan. With that strategy, you are putting your house to work in an investment that has historically out performed the real estate market, yet you are not putting up any of your own cash to buy the stocks.

When people talk of risk the phase “The higher the risk, the higher the reward†often comes up. Unfortunately, that is a misquote – the real quote is the higher the risk, the higher the POTENTIAL reward. Wealth is built more on the management of risk than it is on the return on investment. Learn to manage risk and the return will pretty much take care of itself.