President Obama wants to increase taxes on the rich because he says it’s not fair for the rich to pay a lower tax rate than the middle class. How the President came to this conclusion is a very confusing. Last time I checked, the US had a progressive income tax system – meaning the more you make, the more the IRS takes.

Of course, the only reason Obama is doing this is to grand stand. He knows that his plan will never pass the house. However, I’m quite surprised that nobody has called out the president on his spin about the rich paying a lower tax rate than the middle class.

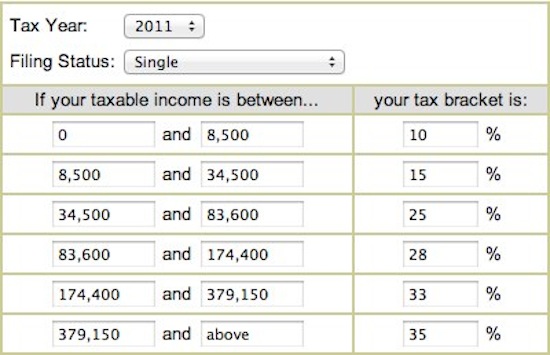

US income tax rate start at 10% and goes up to 35% for people earning more than $379,150.

Now, how is someone making $400K or more, and paying 35% income tax, paying a lower rate than a middle-class person making $50K and paying 25% income tax? As far as I can tell, the rich is paying a rate that is 10% higher. I’m pretty sure the rich would love the pay the same rate as the middle class!

President Obama says this is not class warfare. It is math. He should double check his math.